Waterloo’s Financial Planners

No more uncertainty about your financial future.

Start planning your finances so you can retire early and live comfortably. Trusted by families across Waterloo region.

Let’s Make Your Financial Goals a Reality

For years, we’ve done long-term financial planning and wealth management for seniors, young couples, low-income households, people in debt, and families with generational wealth across Waterloo Region. Let us create a bulletproof financial plan that protects your future, no matter what life throws your way.

We don’t believe in one-size-fits-all strategies. Every financial plan we build is designed to:

Adapt to your life goals, whether it’s retirement, buying a home, or getting out of debt

Withstand market changes and economic uncertainty

Protect your family’s financial security for generations

“A mutual friend introduced us to Elie. Besides just loving dealing with him (a good honest guy) in a nutshell in the investments he's recommended we've had absolutely excellent results. In fact our portfolio has increased in value by over 25% in just the few years we've been dealing with him. Just excellent :).”

— DAVE HACHEY, GRFS CLIENT

Our Financial Planning & Wealth Management Services Include:

Financial Planning

Build a roadmap for your short- and long-term goals, from paying off debt to preparing for retirement.

Tax Reduction Strategies

Minimize your tax burden with smart, year-round planning that helps you keep more of what you earn.

Debt Reduction Strategies

Regain control of your finances with practical, structured approaches to reduce and eliminate debt.

Insurance & Risk Management

Protect what matters most with coverage strategies that safeguard your income, family, and future wealth.

Investment Planning

Build a diversified investment strategy designed to grow your wealth and protect it through every market cycle.

Retirement Planning

Create a sustainable retirement income plan that lets you enjoy life without financial stress.

Our Financial Planning Process

What you can expect when working with our financial planners

Step 1: Learning About Your Financial Goals

During our first consultation, we look to understand what your short-term and long-term financial goals are. Most people in Waterloo have goals like buying a house, saving for retirement, reducing debt, or going on a lavish vacation. Whatever your goals are, our job is to help you make it happen.

Step 2: Understanding Your Current Income

Your current income acts as a baseline of what we can do now and how we can realistically achieve your short-term and long-term financial goals. This is part of how we chart out a realistic timeline for you to make your goals happen.

Step 3: Managing Current Household Expenses

Managing expenses is the key to saving money while maintaining your financial wellbeing. We make smart recommendations about limiting expenses, but only you can choose what expenses are worth giving up.

Step 4: Building an Emergency Fund

A big goal early-on is building an emergency fund if you don’t already have one. An emergency fund is more than money put aside, it’s your safety net. It shields you from financial stress when unexpected expenses arise, like your car breaking down, or an emergency vet bill.

Step 5: Investing for Your Future

Once your foundation is in place, we help you put your money to work. Investing isn’t about chasing trends or taking unnecessary risks… It's about building steady, long-term growth that aligns with your goals and comfort. Whether you’re investing for wealth building, major purchases, or financial independence, we help you choose strategies that make sense for you.

Step 6: Reducing the Tax Burden

Many Canadians are overpaying their taxes. We help identify tax-efficient strategies that keep more of your hard-earned money working for you. From income planning to investment structuring, our goal is to legally reduce your tax burden while supporting your short-term and long-term financial plans.

Step 7: Planning for Retirement

Saving for retirement can feel intimidating, that’s why we’re here to simplify it. We help you understand how much you’ll need, where that income will come from, and how to adjust your plan as life changes. Whether retirement is decades away or right around the corner, we help you prepare with confidence.

Step 8: Financially Protecting Your Business

If you’re a business owner, protecting what you’ve built is just as important as growing it. We look at ways to safeguard your business and personal finances from unexpected risks, including illness, disability, or economic downturns. This often involves investing in a valuable insurance plan to protect every aspect of your life and business.

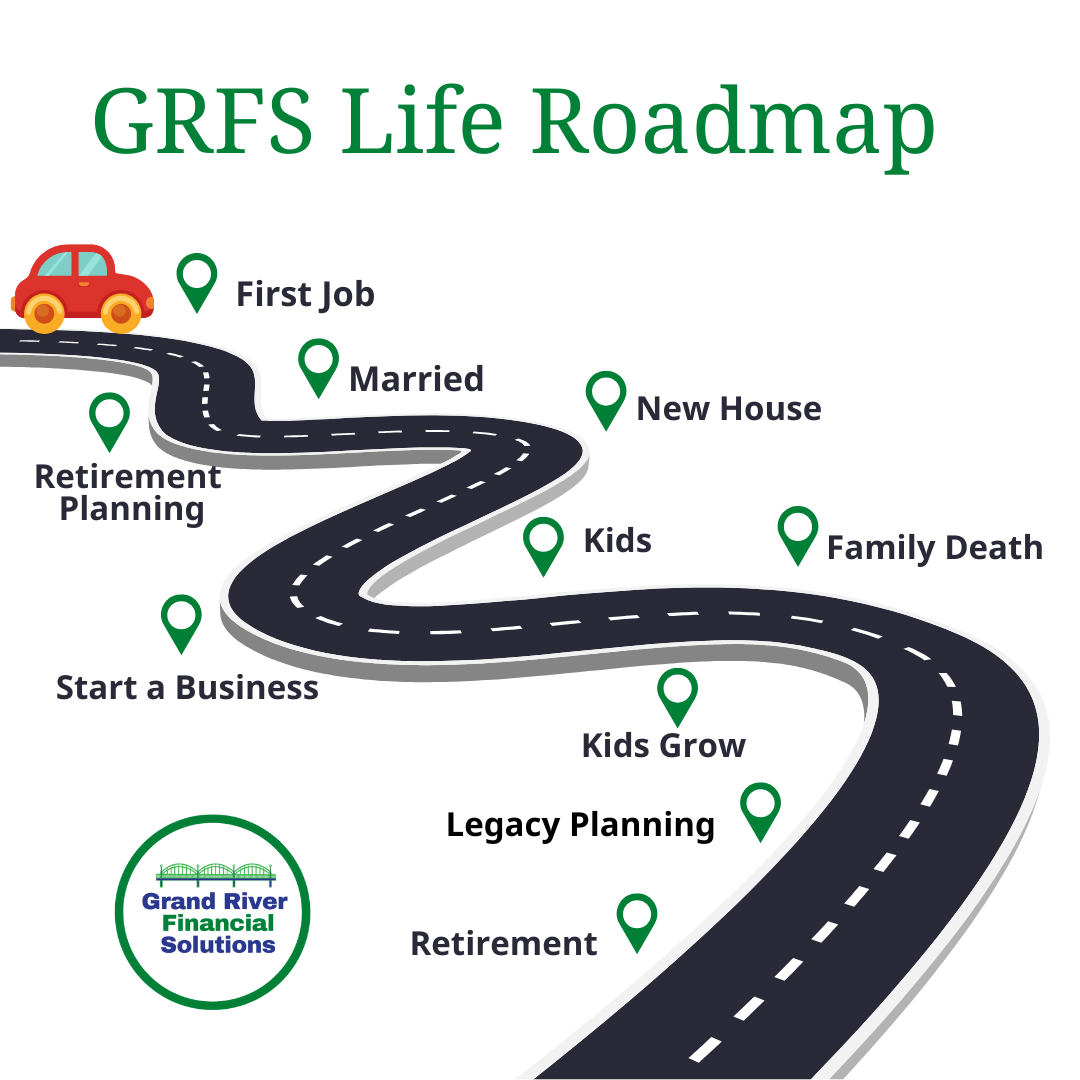

Pillars of the GRFS Financial Life Roadmap:

-

→ Budgeting, debt strategy, income protection

→ Start your RRSP, TFSA, and emergency fund -

→ RESP planning & education goals

→ Life insurance & estate basics

→ Mortgage advice -

→ Investment strategies for families

→ Mid-term planning: vacation, home renos, career changes

→ Tools for inflation-proofing your future -

→ Wills, powers of attorney, digital legacy planning

→ Family financial wellness check-ins

→ Secure support for life’s “what ifs”

Ask a Waterloo Financial Advisor

Frequently Asked Questions

-

Yes, we welcome anyone to work with our financial planners regardless of income!

You don’t need to be wealthy to work with a financial planner — in fact, financial planning can be even more valuable if you’re on a lower income.

We can help you:

Create a realistic budget for your income and financial goals.

Work toward repaying debt while still saving money.

Take advantage of tax credits and government benefits you might be missing.

Build an emergency fund to reduce financial stress.

Develop long-term financial habits for growing your wealth.

-

Yes, financial planning can absolutely help you retire comfortably. We’ll help you manage your income, investments, and savings now so that you’ll be able to meet your goal of retiring in the future.

To ensure your retirement savings are future-proof, we plan for taxes and inflation, and prepare for unexpected events.

-

When working with a financial planner in Waterloo, you should expect localized financial advice and planning that accommodates Waterloo’s everchanging market and economy.

Getting Started: Our financial planners will ask you about your short-term financial goals (emergency fund, vacation) and long-term financial goals (retirement, mortgage). These goals will guide how we plan and what financial strategies we suggest to optimize your savings and investments.

A Wide Range of Financial Advice: We use our years of financial experience to help you build wealth and meet your goals. We have a diverse set of professionals specializing in Tax Planning, Investment Planning, Retirement Planning, Mortgage Advising, Bookkeeping and more — all of which work in tandem to bring your finances to where you want them to be.

Read More: What to Expect from Financial Planning Services in Kitchener

-

Yes, our clients are protected by confidentiality. In Kitchener-Waterloo, Financial Advisors/Planners have a legal and ethical duty to maintain confidentiality. We will not disclose any information about our clients to anyone for any reason, unless the client provides written consent. We have a duty to protect any information about our client that is not available to the public, even if it doesn’t involve the client’s financial planning.

-

Yes, in some cases.

What is Deductible: In Ontario, advisory fees are deductible if they’re paid directly by the investor for advice or management of specific shares or securities (like stocks, bonds, mutual funds, or ETFs).

What’s Not Deductible: Commissions, fees for registered accounts (RRSPs, TFSAs, etc.), segregated fund fees, and general financial planning costs are not deductible.

Generally, only direct fees for managing or advising on non-registered investments qualify for a tax deduction.

If you choose to work with GRFS financial planners, our tax planners will help ensure you take advantage of all applicable deductions.

You’re building a life full of love, purpose, and plans. But financial uncertainty shouldn’t slow you down. GRFS helps young families map out the journey — from first RESP to legacy planning — with clear advice and personalized support every step of the way.

Financial Planning To Thrive In Waterloo’s Changing Economy

Major Changes

Mortgage Renewals

Living Expenditures

Recent Life Changes; kids, house, marriage

Surprise Costs; house, accident, car troubles

Health Related Events

About The Financial Planning Process

Retirement, goals to purchase a home, preparation for the future are all things that begin with the process of Financial Planning.

Our financial planning helps you navigate the immediate financial landscape. We work closely with you to craft a budget that aligns with your current income, carefully manage expenses, and build an emergency fund to provide a safety net for unexpected financial challenges. Our goal is to empower you to meet short-term objectives efficiently, whether it's saving for a vacation, reducing high-interest debt, or addressing immediate financial priorities. With our guidance, you can confidently take control of your financial present and position yourself for a secure future.

The GRFS team focuses on you, your goals, and considerations when collaboratively tackling the financial planning process. Your life is unique, your plan should be as well.

Benefits of a Financial Plan

A well-structured financial plan provides numerous benefits. It offers clarity and direction by helping you set clear financial goals and priorities. Financial planning encourages disciplined saving and budgeting, reducing financial stress and improving creditworthiness. It enhances financial security through strategies like insurance coverage and emergency funds, ensuring preparedness for unexpected events. Moreover, a sound financial plan can optimize investments, potentially increasing wealth over time. Ultimately, it brings peace of mind, alleviating stress and allowing you to focus on enjoying life while working towards your financial dreams.

The GRFS team will help you identify the benefits available and realistic targets via a financial plan.

Wants

Travel

New House or Renovations

Family Celebrations

Education

Job / Career Change

Hello Life Retirement Insurance from Canada Life

Hello Life Retirement from Canada Life is a comprehensive retirement planning platform that provides individuals with a variety of tools and resources to help them plan for their retirement. The platform is designed to be user-friendly and accessible to everyone, regardless of their level of experience with retirement planning.

Hello Life Retirement offers a range of features, including personalized retirement plans, investment guidance, retirement income projections, and an extensive library of articles and videos on retirement-related topics. Users can track their progress, set goals, and connect with a community of like-minded individuals who are also planning for their retirement.

The platform covers a broad range of retirement topics, from saving and investing to tax planning and estate planning. It is an excellent resource for anyone looking to take control of their retirement planning and make positive changes in their financial future. Whether you're just starting your career or nearing retirement age, Hello Life Retirement has something to offer for everyone.

As a product of Canada Life, a trusted provider of financial and retirement planning services, Hello Life Retirement offers users the confidence and security of knowing that they are receiving expert guidance and support throughout their retirement planning journey.